The missile war in the Middle East, the US entry into the war, and Iran’s threat to block the Strait of Hormuz in the Persian Gulf are already leading to initial oil price increases: Economic bloggers are reporting increases of as much as 11 percent. If this continues, all motorists and freight forwarders will be desperate at the gas stations in a few days.

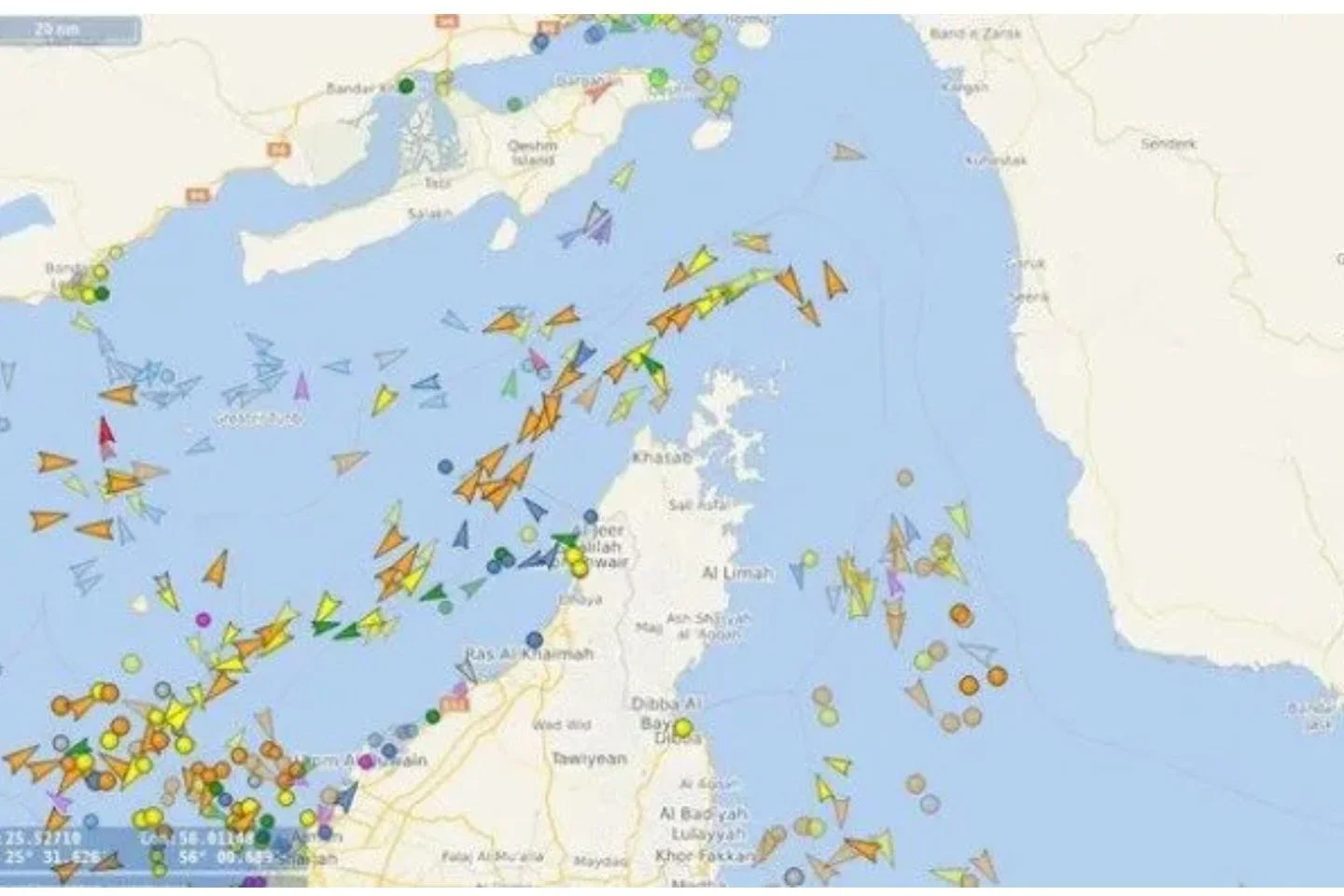

“Iran is already openly threatening to block the Strait of Hormuz. Oil prices could explode worldwide – a geopolitical powder keg that could go off at any moment. In this scenario, Germany is likely to slide into a recession with growth of minus one to minus five percent, depending on how long the blockade of the Strait of Hormuz lasts. What is particularly critical is that the German economy is already in a weakened state for reasons we are all aware of,” fears German economic blogger Emanuel Boeminghaus. His warning also applies, of course, to much smaller Austria, which is currently facing much greater economic problems – and also has to reduce its enormous budget chaos.

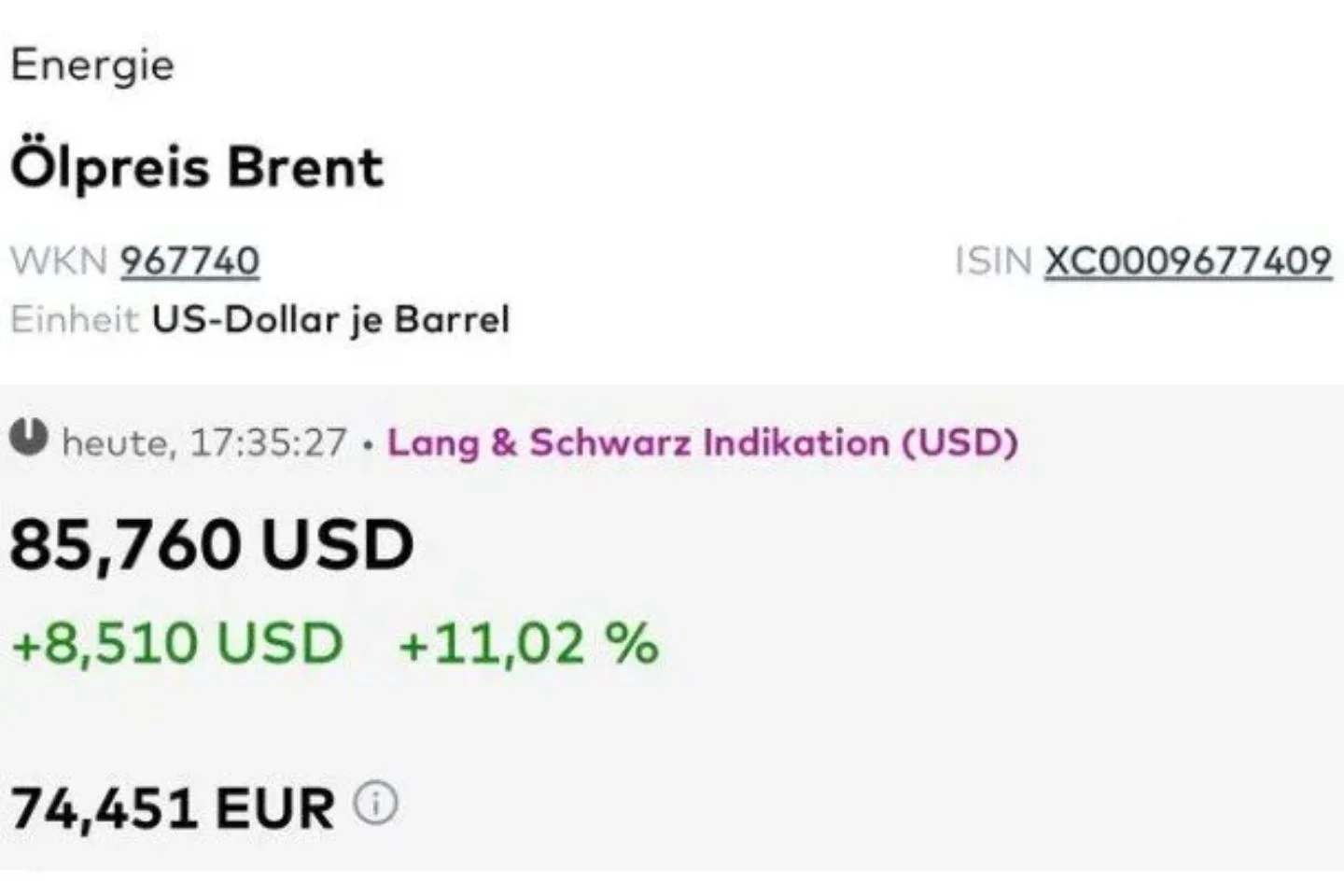

Price increases feared – it’s already starting

A few minutes ago, Boeminghaus provided the first figures on X: “Initial price increases of 11 percent!” More will be known about the overall development tomorrow, Monday, but the charter companies of the large oil tankers have already increased their prices significantly, as reported by exxtra24: www.exxtra24.at/oel-tanker-kosten-steigen-kommt-jetzt-die-spritpreis-bombe-der-mullahs/

The cost of a very large crude oil tanker (VLCC) on the route from the Persian Gulf to China rose from US$19,998 per day to US$47,609 within a week. This development will soon affect all end consumers.

But it is not only oil imports that would become massively more expensive if Iran were to block the Strait of Hormuz, but also LNG gas. Boeminghaus writes on X: “Germany’s gas storage facilities are currently not sufficiently filled for the winter. If the Strait of Hormuz were blocked, 6 to 10 LNG tankers would be lost immediately every day, which would severely tighten the global market and trigger massive price jumps – similar to or worse than during the Ukraine war.”

Credit: Screenshot/APA

Recent Comments